Growth: financial metrics

10 de May, 2022More on NPS

23 de May, 2022The financial outcome must always be used as one of the metrics that indicate that the company is being successful and that it is reaching its goal. However, it must not be considered in isolation, because there is good revenue and bad revenue.

Bad revenue is all revenue that comes at the expense of the relationship with the customer. For instance, a company that hinders their clients’ cancellation button when they want to cancel or when it sells something overpriced taking advantage of their needs, such as the price of a bottle of water in a hotel.

Good revenue is all revenue that comes from deals where we can make our customers happy, where they feel we’ve solved their problem. It’s revenue we can build on by getting even more businesses from loyal customers, who typically recommend our product or service to their friends.

The bad revenue may help the company in the short run; however, in the long run, clients will get tired of this behavior and will seek alternatives. That is, bad revenue can eventually kill your company in the long run.

It is not possible to differentiate the good from the bad revenue in a financial report, in which all you can see is revenue numbers without any information on the client’ satisfaction grade. Because of this, it is necessary to listen to your customers, measure their satisfaction, and correlate it with the financial results.

NPS – Net Promoter Score

There are many ways of measuring clients’ satisfaction. I really like one called NPS (short for Net Promoter Score). This metric has come up for the first time in 2003, in a Harvard Business Review article written by Fred Reichheld, consultant at Bain & Company, a renowned American company. In 2006, Reichheld wrote a book called The Ultimate Question [^nps] that had a second edition published in 2011, containing the lessons learned through the years.

[^nps]: The Ultimate Question 2.0 (Revised and Expanded Edition): How Net Promoter Companies Thrive in a Customer-Driven World by Fred Reichheld and Rob Markey, Harvard Business Review Press; Rev Exp edition (2011)

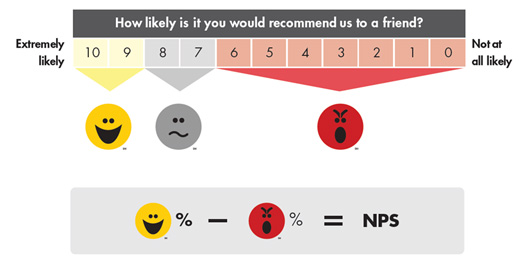

NPS is calculated based on a single question you should ask your client:

The NPS main question:

In a scale from 0 to 10, how likely would you tell a friend or colleague about us?

Zero means absolutely not, and 10 meaning absolutely yes. People who evaluated from zero to 6 must be classified as detractors; the ones who graded 7 or 8 must be classified as neutral, and the ones who graded 9 or 10 are promoters.

The NPS calculation is very simple, just subtract the detractors’ percentage from the promoters’ percentage. The result is a number varying from -100% to 100%. A negative number means that you have more detractors than promoters, and a positive number means the opposite, that is, you have more promoters than detractors.

Of course, it’s better to have more promoters than detractors, mainly if we think about the word-of-mouth marketing that comes from both detractors and promoters. Aside from talking about your company and services to their friends, the promoters buy more and are customers for longer. That is, they like your product or service, and will always give you ideas and suggestions that are important to your business.

Several companies use NPS to measure their clients’ satisfaction and loyalty. Some examples are Apple, Zappos, Rackspace, Microsoft, Intuit, and Facebook.

However, how often should you measure NPS? Once a year? Every semester? Every month? Every week? The book recommends measuring it every day, continuously. That can be done in the following way: every day you ask the NPS question to clients who are celebrating the X months or X years anniversary that day.

For instance, you can ask your clients when they complete 1 month since they have become your clients, then you can pick up some onboarding issues. You can also ask your 6-months clients and, from thereon, at each 1-year anniversary at the company. This way you can get NPS reports per time the client is your client, then you will know if you’re treating well both new and old clients. To check if your NPS is evolving, you take the moving average from the last 30 days.

Closing the loop: from information to action

The big problem here is that a number doesn’t solve much. We need to know where to improve, what to do so the promoters continue to promote our company and services, and what motivated the detractors to give us a low score. To get this information, Fred Reichheld recommends adding one more question to the survey:

The NPS second question:

What is the main reason you gave us that grade?

There you go. With these answers in your hands, you have what it takes to go from information to action. While reading the comments of the promoters, you will understand what motivated them to give you a high score and keep these actions. From the comments on the low scores, you have the first input to take action. It is very important to talk with the detractors to listen to more details on their dissatisfaction.

From the moment they see you care, their perception of your company will start to improve. To seek for understanding the detractors’ motivation and act to solve the problems that got them unsatisfied is the only safe way to increase the NPS and, consequently, the loyalty of your clients.

Maybe you are asking yourself when is the time for this feedback. The answer is quite simple and direct: the sooner, the better. In his book, Fred Reichheld advises getting in touch with the detractors in a maximum of 48 hours. Speed is important to show you read and care about your client’s feedback.

Tip: internal NPS

An interesting suggestion in the book is to measure the employees’ NPS, that is, on a scale from 0 to 10, how much this employee would recommend your company for a friend to work there. This questionnaire would have to be anonymous to make the employees comfortable while making comments on any problem they have within the company.

Following the path of NPS clients, you can run this NPS by seasons, that is, 1 month, 6 months, and each one-year anniversary at the company. This way you will be able to find out if employees had a good process for entering the company, and if they are still motivated after a few years.

So, we saw several types of metrics, began with the conversion funnel and talked about engagement, churn, global and individual financial metrics, revenue churn, and the “Holy Grail” of subscription products — the negative churn. Now, we will finish the topic by talking about the loyalty metrics — the NPS. In the next chapters, I’ll make my final considerations on the metrics theme.

Mentoring and advice on digital product development

I’ve been helping several companies extract more value and results from their digital products. Check here how I can help you and your company.

Digital Product Management Books

Do you work with digital products? Do you want to know more about how to manage a digital product to increase its chances of success, solve its user’s problems and achieve the company objectives? Check out my Digital Product Management bundle with my 3 books where I share what I learned during my 30+ years of experience in creating and managing digital products:

- Startup Guide: How startups and established companies can create profitable digital products

- Product Management: How to increase the chances of success of your digital product

- Leading Product Development: The art and science of managing product teams

You can also acquire the books individually, by clicking on their titles above.