Continuing Education Program New instructors

9 de May, 2024

Focus on the problem

21 de May, 2024The next case study on deliver early and often comes from Itaú Unibanco, one of the largest financial institutions in Latin America. The group, in operation since 1924, has embraced technology since the early 1960s. It started using machines for tallying current accounts, document authentication, and launching credit and debit cards. In the 1980s, it began using ATMs, being responsible for the launch of Brazil’s first ATM. Between the 1990s and the early 2000s, the advent of the internet and mobile banking positioned them as early adopters in the market. Similarly, the systemic platform began with IBM on the mainframe and gradually evolved into distributed platforms and cloud computing. The ongoing commitment to evolution and consistency in research and development is also evident recently with applications in artificial intelligence, quantum computing, and blockchain.

For Itaú, mobile banking opened up a new avenue for customer relations, driving investments in technology. As the largest private bank in Brazil, everything at Itaú is on a large scale: with over 100,000 employees, including more than 15,000 developers who collaborate with product and design professionals. The bank’s digital transformation journey has been motivated by a customer-centric strategy for several years, featuring initiatives related to organizing teams into multidisciplinary communities, adopting experience design methodologies and agile work, modernizing applications using public cloud, and intensive use of data. While Itaú has addressed these topics over the years, there have been some important initiatives from which it has gained valuable insights.

In the early 2010s, the bank organized an innovative project called “Salas,” where multidisciplinary teams with individuals from product, technology, design, anthropology, among other fields, worked physically together, guided by KPIs, business results, and shared objectives. In 2015, they had the first initiatives where structuring projects traditionally planned over several years were re-planned with a more agile approach, delivering value over months. There were also significant learnings from channel teams, with around 300 people organized into squads and the adoption of agile methods.

In 2017, the technology department underwent a reorganization into delivery communities, where approximately 5,000 people were organized into 50 communities (referred to as tribes within Itaú’s terminology), comprising around 500 squads. However, it was recognized that, although this was a significant step, it would still be necessary to involve other business areas of the bank to move toward business agility. In Itaú’s context, business agility denotes rapid, continuous, and systematic evolutionary innovation and adaptation to gain and maintain a competitive advantage. The need for experimentation with the bank’s first integrated community arose from real customer needs, particularly in the investment solutions community, leading to valuable insights. The notable difference was the buy-in from business leaders to experiment with this model.

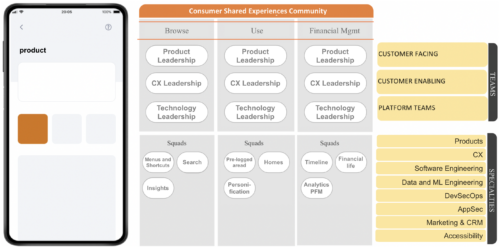

Edson Cesar Portilho, CTO of one of the communities, explains that teams are organized in a topology composed of individuals with different profiles and specialties, including technology, product, operations, marketing, design, data, and risk (among others). These multidisciplinary teams work with a focus on customer needs and business results. Currently, there are approximately 20,000 people working in this model, across more than 2,000 squads distributed in around 80 communities.

There are two types of communities:

- Integrated Communities: Deliver solutions oriented to customer needs, such as payment needs, which encompass communities for credit and debit cards, Pix, and payment slips. Another example is short-term financing needs, composed of communities for consortiums, insurance, credit, and so on.

- Technology Enabler Communities: Build tools and technical products for integrated communities to focus on developing solutions and digital products for Itaú’s customers, rather than worrying about these more technical foundations. This category includes communities that enable, streamline, and accelerate the use of public cloud, APIs, CI/CD, data, design systems, and agile product management, among others.

Aline Pavan, a superintendent working with Itaú’s digital channels, mentions that integrated communities are responsible for the end-to-end customer experience, leading them to operate in various layers of software development (front-end, back-end, data architecture, etc.). An example of the principle of rapid and frequent deliveries is the mobile application. With around 20 million recurring customers and an NPS in the excellence zone (above 70), the Itaú app is well-established among customers, gaining more significance in acquiring new customers and selling products. It combines traditional financial products with experiences like Itaú Shop and iPhone Forever, forming the Beyond Banking initiative.

If technology is crucial for the continuous evolution of Itaú’s products and services, people are fundamental to ensuring a customer focus. Transforming the working model involves not only reorganizing functional structures but mainly providing pillars to guide expected team behaviors and align incentives. As part of this transformation plan, a new Itubers Culture was launched in 2022, consolidating values that define people’s way of being and acting in the coming years. The revamped cultural pillars maintain values such as ethics and make room for agile and collaborative principles in a constantly transforming world, recognizing the need for diversity and continuous learning.

By creating the necessary architecture for integrated communities to operate on their journeys, these communities can make changes and experiments with great agility. Currently, about 20 different communities deploy changes to the same application, such as the Investment and Consignment communities, both featuring their financial products as part of the Itaú app. Customers of Itaú experience this dynamism when using the app daily, which is always introducing new features. The number of releases in the app doubled from 2020 to 2022, and on average, teams make changes to it every 4.9 days.

Community model that aims to specialize/evolve Itaú’s products and services based on customer needs.

Community model that aims to specialize/evolve Itaú’s products and services based on customer needs.

Architecture Mechanisms for Ensuring Scale:

- Use of Enablers from the Engineering Perspective: This adoption occurs during development, ensuring that ready and tested components can be used in different compositions. Examples include static source code security analysis, man-aged by CTOs and standardized for all communities, or a library for capturing customer navigation data, democratizing this data for anyone needing access. Notably, resilience and observability programs capture data from all deployed applications, adding a qualitative bias of expected availability based on criticality for customers and business. This “score” determines the infrastructure used for applications and the need for joint review with a team of specialists in different disciplines (reliability, security, infrastructure, etc.). This demonstrates that not all processes are automated, and the team collaborates whenever necessary.

- Use of Enablers Ensuring Consistency of Customer Experience: Collaborative work between products and engineering to define and reuse components necessary for the customer journey, ensuring ease of parameterization and A/B testing, the ability to capture customer feedback during a transaction in the app with a visual and display rule standard, and the ability to provide an omnichannel experience to encourage contact with the manager whenever the customer needs it. This reuse, in particular, helped Itaú grow 4x in efficiency in generating leads for branch managers and generated a 30% increase in sales from this mechanism.

- Conducting Tests: All features are gradually released to the customer base, and in addition to direct feedback, inputs are collected from design and accessibility teams that provide feedback to the development pipeline.

- Monitoring Community Results through OKRs: A set of indicators that balance the evaluation of customer satisfaction, conversion, operating costs (Product and FinOps), availability rate, and error rate of the journey.taxa de erros da jornada.

This case study demonstrates that, despite the large scale and complexity of Itaú’s business, the team has successfully built and evolved the necessary architecture to provide agility, essential for their business communities to experiment and adapt their products to their customers quickly and frequently.

Recommendation

This recommendation section relates to the entire chapter 7 of the book Digital Transformation and Product Culture, including the articles Deliver early and often, Measuring and managing the productivity, Case study: Dasa Group, and this case study about Itaú Unibanco.

I have encountered several organizations that adopted some terminology from technology companies (sprint, squad, discovery, etc.) and thought they had undergone digital transformation, only to deliver software to the customer once every 3 or 6 months.

Technology is constantly evolving, just like the needs of your customer, and the context in which your company operates is also constantly changing. If you don’t create an environment that allows for fast and frequent deliveries, to the point where your company can test, experiment, and deliver software multiple times a day, your company won’t be able to harness the full potential of technology for the benefit of its strategic objectives and its customers.

Summing up

This summing up section relates to the entire chapter 7 of the book Digital Transformation and Product Culture, including the articles Deliver early and often, Measuring and managing the productivity, Case study: Dasa Group, and this case study about Itaú Unibanco.

- Deliver early and often is the first principle because, without them, all others are much less effective. What’s the use of fo- cusing on problems and delivering results with an ecosystem mindset if you only deploy software every 3 or 6 months?

- There are four reasons for making fast and frequent deliv- eries: 1) having the product in the hands of the user = the moment of truth; 2) avoiding excess features; 3) accelerating the return on investment; and 4) reducing uncertainty.

- There is no silver bullet for increasing the productivity of a product development team. However, there are two es- sential actions to help in this objective. The first action is measurement. There is no way to improve something that is not measured. The second action is to bring the topic of productivity to the center of the discussion.

- Increasing productivity is of no use if the quality declines. A good proxy metric for quality is bugs: bug inventory, new bugs per week, and SLA for bug resolution. In addition to bug management, it is necessary to monitor other non-functional requirements related to quality, such as performance, scala- bility, operability, and monitorability.

- Quality is paramount to provide a good user experience. Moreover, it is fundamental for increasing the speed of your product development team. The fewer bugs a team has to fix, the more time they will have to focus on new things.

- High-velocity organizations can learn very quickly— especially from their failures—and absorb this learning as an integral part of the organization’s knowledge.

Digital transformation and product culture

This article is another excerpt from my newest book “Digital transformation and product culture: How to put technology at the center of your company’s strategy“, which I will also make available here on the blog. So far, I have already published here:

- About the book

- Part 1: Concepts

- Chapter 1: The so-called digital transformation – Project and Product

- Chapter 2: Uncertainty and digital transformation

- Chapter 3: Types of company

- Chapter 4: Type of company vs digital maturity

- Chapter 5: Business models

- Chapter 6: Agile, digital and product culture

- Part 2: Principles

Workshops, coaching, and advisory services

I’ve been helping companies and their leaders (CPOs, heads of product, CTOs, CEOs, tech founders, and heads of digital transformation) bridge the gap between business and technology through workshops, coaching, and advisory services on product management and digital transformation.

Digital Product Management Books

Do you work with digital products? Do you want to know more about managing a digital product to increase its chances of success, solve its user’s problems, and achieve the company objectives? Check out my Digital Product Management books, where I share what I learned during my 30+ years of experience in creating and managing digital products:

- Digital transformation and product culture: How to put technology at the center of your company’s strategy

- Leading Product Development: The art and science of managing product teams

- Product Management: How to increase the chances of success of your digital product

- Startup Guide: How startups and established companies can create profitable digital products